BTWmate

Scan your receipts quickly

About

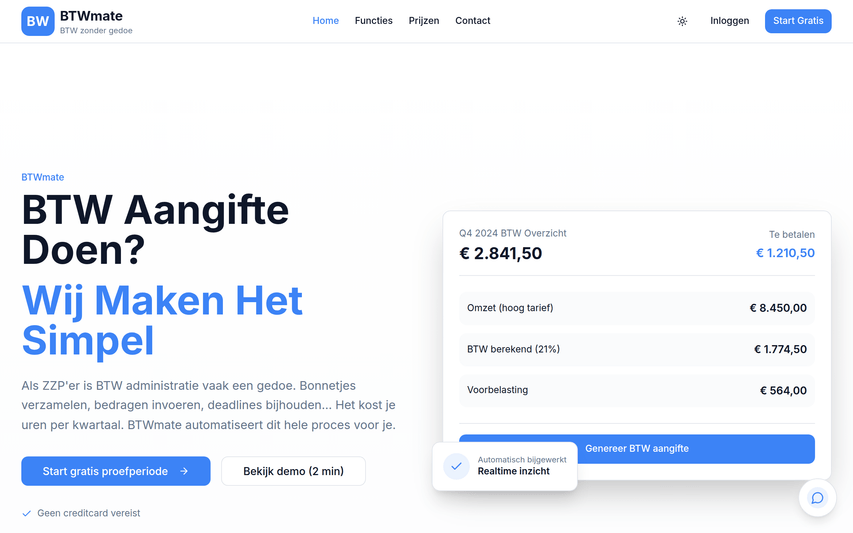

As a freelancer, VAT administration is often a hassle. Collecting receipts, entering amounts, keeping track of deadlines... It takes hours every quarter. BTWmate automates the entire process for you. Simply upload your receipts via the app, email, or bulk upload. Our AI automatically extracts all relevant data and categorizes it correctly.

Key Features

Smart Receipt Capture

Upload receipts via mobile app, email or bulk upload. The app automatically imports images and PDFs for processing.

AI Data Extraction (OCR)

Automatic OCR extracts key fields — vendor, date, amounts, VAT rates and invoice numbers — even from noisy or photographed receipts.

Automated Categorization & VAT Calculation

AI classifies expenses into categories and calculates VAT amounts, making VAT reporting and bookkeeping consistent and faster.

Bulk Processing & Email Import

Process large batches of receipts at once or forward receipts to a dedicated import email to save manual entry time.

Export & Integrations

Export processed data to CSV or common accounting tools to hand off to your accountant or import into bookkeeping software.

How to Use BTWmate

1) Sign up and set your VAT preferences and categories. 2) Upload receipts using the mobile/web app, forward them to the import email, or perform a bulk upload. 3) Let the AI scan and extract fields; review and correct any items if needed. 4) Export the cleaned data or connect to your accounting software to generate VAT reports or hand off to your accountant.