Peaceful Mindful Pocket

Financial management platform offering zero-based budgeting tools and expert coaching for individuals and institutions.

About

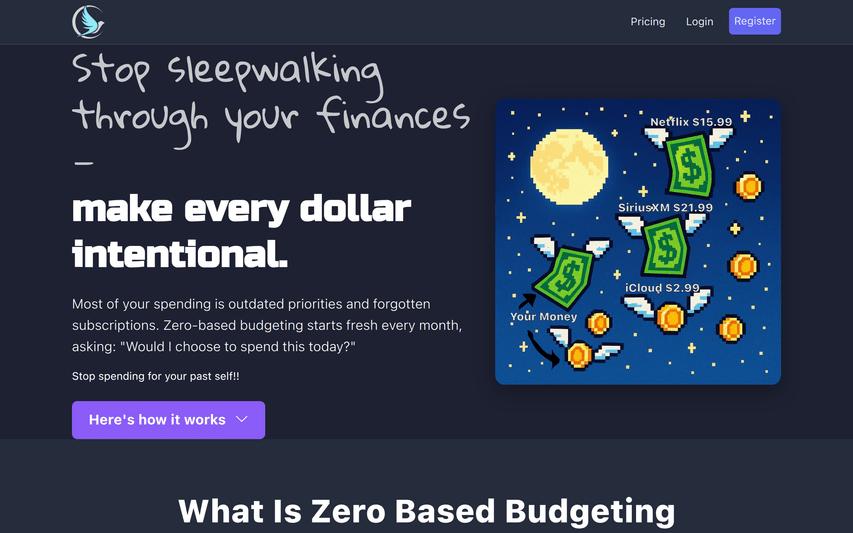

Peaceful Mindful Pocket is your personal guide to taking full control of your finances with intention and clarity. This innovative tool helps you stop sleepwalking through your spending habits and empowers you to make every dollar work for your goals. By combining practical financial insights with mindful techniques, Peaceful Mindful Pocket encourages thoughtful budgeting, conscious saving, and strategic planning so you can align your money with your values.

Key Features

Zero‑Based Budget Planner

Create a fresh monthly budget where every dollar is assigned a job. Templates and example buckets are provided and can be renamed to match your lifestyle.

Bank Sync & Transaction Import

Connect accounts via Stripe for read‑only access to import transactions automatically, so your plan is compared to real spending in minutes.

Drag‑and‑Drop Transaction Categorization

Easily associate transactions with budget buckets using drag‑and‑drop (or searchable double‑click) to see how actual spending changes your planned amounts.

Expert Coaching & Support

Access one‑on‑one coaching and guidance to accelerate results, troubleshoot messy situations, and build strategies for saving, debt payoff, and values‑aligned spending.

Bank‑Level Security & Privacy

256‑bit SSL encryption, US‑only data storage, read‑only bank access, and a strict no‑sale data policy to protect your financial information.

How to Use Peaceful Mindful Pocket

1) Customize your demo budget: rename or remove example buckets so categories match your life (30–60 mins). 2) Enter income: add your paychecks and expected amounts so the app knows your monthly total (15–30 mins). 3) Give every dollar a job: assign planned amounts to each bucket until planned income minus planned spending equals zero (30–60 mins). 4) Connect your bank via the gear icon (Stripe), import transactions, and drag/drop each transaction into buckets to compare actual spending to your plan — iterate and adjust as you collect data.