Fere AI

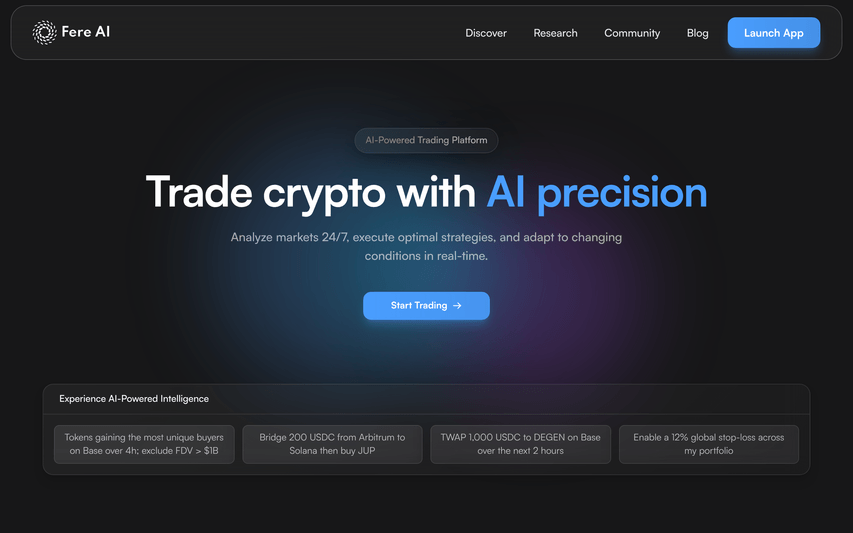

AI trading agents that research, analyze and execute crypto trades 24/7.Multi-chain autonomous trading.Free to start.

About

Fere AI is the leading AI-powered platform for autonomous crypto research and trading — think ChatGPT meets Bloomberg Terminal for Web3. FEATURED BY COINBASE: Our platform runs on Coinbase's CDP Server Wallets, enabling secure, chain-abstracted trading across Solana, Base, Ethereum, Berachain, and more via a single API. AUTONOMOUS AI AGENTS: - Pro Agent: Deep-dive token research with filters for themes, investors, chains and trading data - Market Pulse Agent: Real-time sentiment analysis from Twitter, Farcaster and 50+ news sources - Polymarket Dashboard: Trending markets ranked by volume, social mentions and AI — updated every 60 seconds VERIFIABLE AI: Partnered with EigenAI for cryptographically-verified trading decisions — no more black-box algorithms. Used by millions of daily users in the agentic crypto trading revolution. Start free — deploy your first AI trading agent in minutes.

Key Features

Autonomous AI Agents

Prebuilt agents (Pro Agent, Market Pulse, Polymarket Dashboard) that research tokens, scan news/social, and generate actionable trade signals 24/7.

Multi-chain Execution via Coinbase CDP

Execute trades across Solana, Base, Ethereum, Arbitrum and more through a single, chain-abstracted API and Coinbase CDP Server Wallet integration.

Real-time Sentiment & Trending Analysis

Continuously tracks 1M+ social mentions and 50+ news sources to surface momentum, social spikes, and trending assets in near real-time.

Verifiable AI Decisions

Cryptographic verification of agent decisions (partnered with EigenAI) for transparent, auditable trade rationale — reducing black-box risk.

Customizable Risk Controls & Automation

Set portfolio-wide stop-losses, TWAP/limit execution rules, bridge/transfer automations, and deploy agents with configurable risk parameters.

How to Use Fere AI

1) Connect a wallet or create an account and link a Coinbase CDP Server Wallet to enable chain-abstracted trading. 2) Choose a prebuilt agent (Pro Agent, Market Pulse, Polymarket) or create a custom agent with your filters, themes, and risk rules. 3) Configure execution settings (chains, allocation, stop-loss, TWAP/limit parameters) and review the AI's research summary and rationale. 4) Deploy the agent to run autonomously, monitor live alerts and dashboards, and adjust parameters or pause agents as needed.